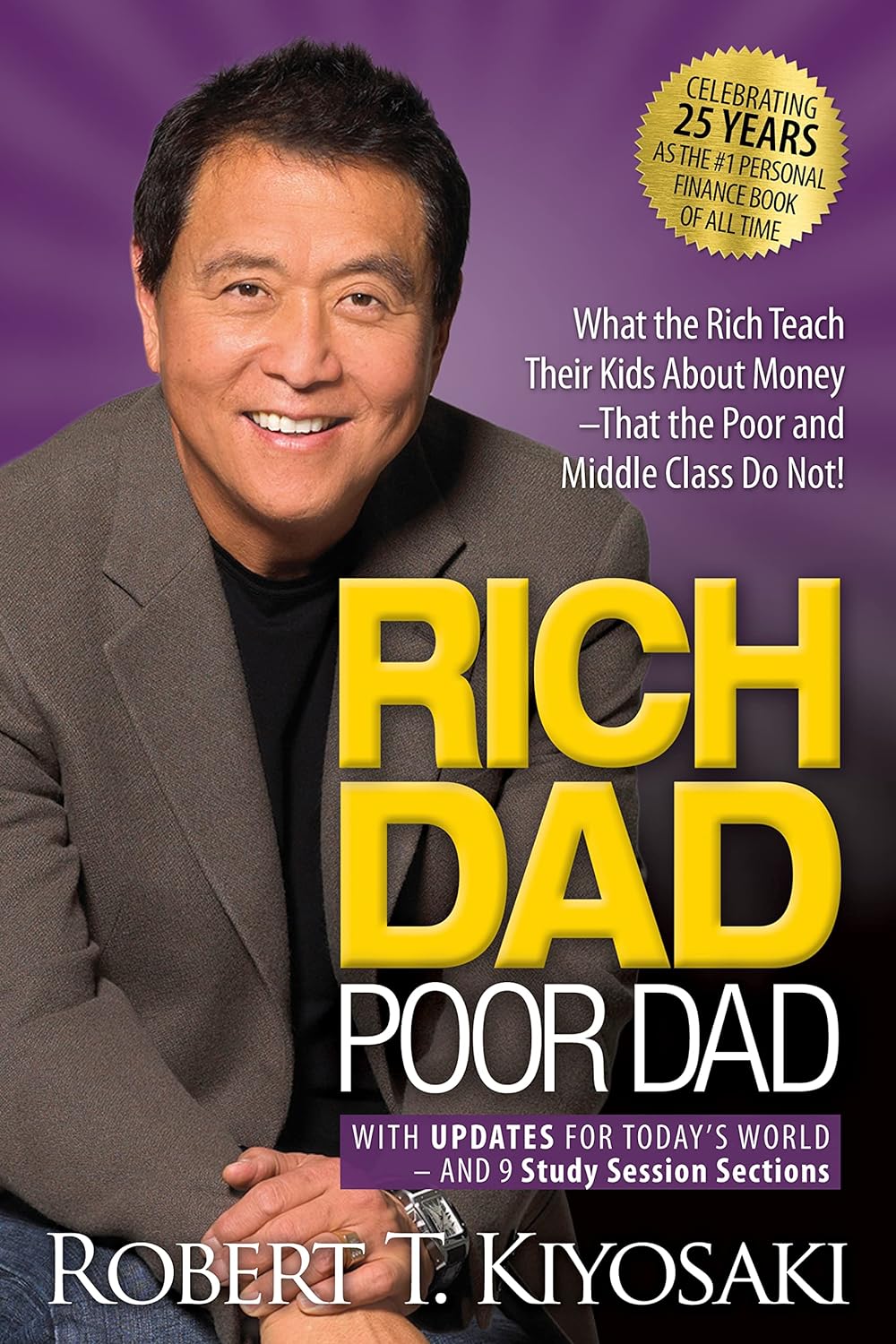

Rich Dad, Poor Dad: A Blueprint for Financial Freedom

Robert T. Kiyosaki’s Rich Dad, Poor Dad is a financial guidebook disguised as an autobiographical tale. The book revolves around the contrasting financial philosophies of the author’s biological father (Poor Dad) and his best friend’s father (Rich Dad). While the Poor Dad, a highly educated man, emphasized the importance of formal education and job security, the Rich Dad, a school dropout, focused on financial literacy, asset acquisition, and building wealth.

Kiyosaki underscores the distinction between income and wealth. He argues that while a high income is essential, it’s how you manage your money that truly determines your financial health. The book emphasizes the importance of acquiring assets, which generate income, rather than liabilities, which drain your resources. This fundamental shift in perspective is a cornerstone of Kiyosaki’s financial philosophy.

Furthermore, Rich Dad, Poor Dad challenges conventional wisdom about money. It encourages readers to think like entrepreneurs, to seek opportunities, and to take calculated risks. The book also highlights the significance of financial education, asserting that schools primarily teach us to become good employees rather than financial stewards. Kiyosaki implores readers to become financially literate and to teach their children the same.

Ultimately, Rich Dad, Poor Dad is a call to action. It urges readers to break free from the ‘rat race’ of earning to spend and instead, embark on a journey towards financial independence. By understanding the difference between assets and liabilities, building multiple streams of income, and cultivating a strong financial mindset, individuals can pave their way to wealth and security.